Weekly Update: Cutting through the noise and Fed Decision

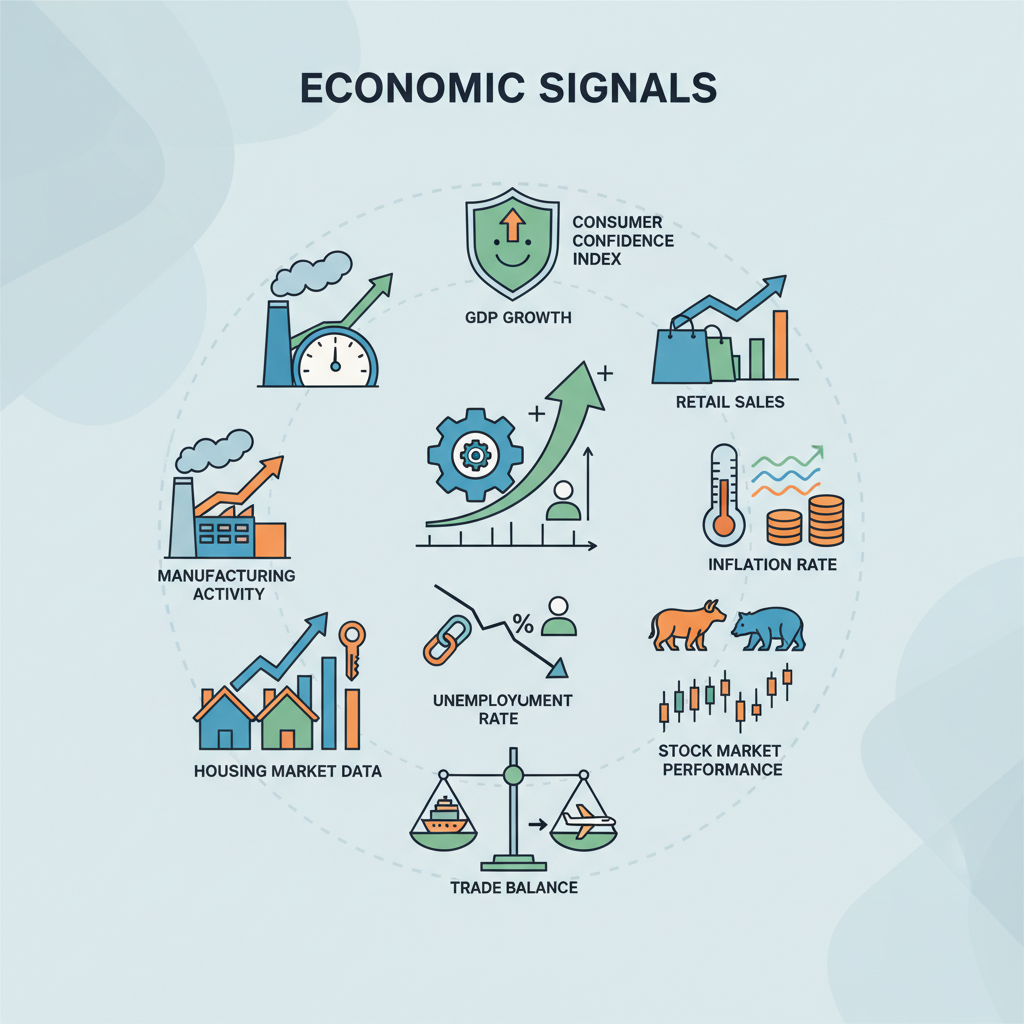

U.S. markets held steady last week as investors awaited the Fed's December 10th decision. Equities notched modest gains, long-term yields crept higher, and incoming data revealed an economy that's cooling gradually while maintaining its underlying strength as inflation pressures continue to ease.

The week's story centered on softer labor and services readings paired with benign inflation figures, solidifying market expectations for another December rate cut. Let's dive into the key developments.

Stock Index Performance

- The S&P 500 increased 0.31%.

- The Nasdaq 100 gained 1.01%.

- The Dow Jones Industrial Average rose 0.50%.

Cutting Through The Noise

- Initial jobless claims hit a three-year low of 191,000, showing layoffs remain scarce. But ADP reported a 32,000 payroll drop while Challenger tracked 71,000 announced cuts, the weakest November since 2022. With official reports delayed, investors are parsing alternative data to gauge whether labor is cooling gracefully or cracking.

- Economic activity in the manufacturing sector contracted in November for the ninth consecutive month. The Purchasing Managers Index (PMI), released by the Institute for Supply Management (ISM), sank to 48.2. Services also showed little spark, with flat activity and slowing orders, though prices held firm. The read: an economy downshifting but not stalling.

- Financial markets are confident in another quarter-point cut at the December 10th Fed meeting. Consensus points to gradual easing, not aggressive rate-slashing.

- The Personal Consumption Expenditures Price Index (PCE) gauge clocked 2.8% year-over-year in September, above target but trending in the right direction. November surveys indicated easing price pressures, keeping the path toward the Fed’s 2% inflation target slow but intact.

The Week Ahead

- Markets are pricing in an 85-90% chance of another 25-basis-point cut, keeping stocks near record highs. Watch the Fed's statement and dot plot for signals on the pace of easing, which will directly impact valuations. Wall Street is betting that PCE and Consumer Price Index (CPI) releases later this month confirm that disinflation continues toward the low-3% range, supporting the soft-landing narrative.

- Weekly jobless claims at a three-year low suggest layoffs remain scarce, yet private payroll data point to a meaningful slowdown ahead. The key question: soft landing or early-stage deterioration? Weaker jobs data would push the Fed toward deeper cuts, while the upcoming official payroll releases will provide the clarity markets need.

The environment of modest growth, easing inflation, and likely Fed cuts continues to favor diversified portfolios tilted toward quality equities and intermediate-term bonds. While next week's Fed meeting and delayed employment data may trigger short-term choppiness, the underlying signals remain constructive for risk assets.

We're here to help you stay the course through any twists and turns ahead. Feel free to reach out with questions or concerns.